Partner badge

Solution Advisory & Delivery

Function

Finance

Industry

Energy & Resources

Region

Global

Akili Oil and Gas Asset Planning Solution

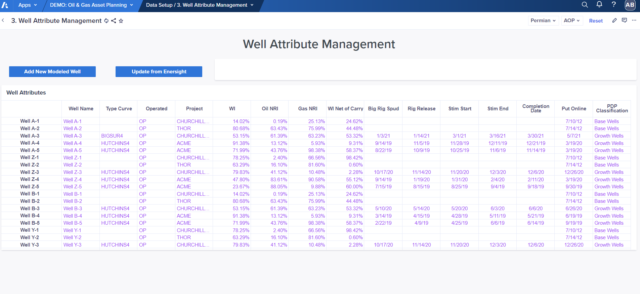

The Akili Oil & Gas Asset Planning solution delivers a well-based planning solution that allows leveraging key data from systems containing engineering data, such as type curve profiles and capital costs, and operational planning data, such as the drilling schedule. This data, along with other data, like pricing assumptions, generates a complete asset forecast.

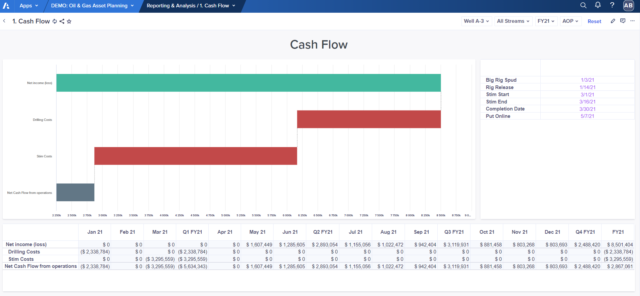

Anaplan’s powerful calculation engine allows altering operating assumptions, immediate assessment of the impact on cash flow, and complete financial outlook over the planning horizon.

Request a demoAkili's Oil & Gas Asset Planning Solution

Akili leverages the power of Anaplan to create a complete asset planning solution that can be implemented very quickly using existing operational data.

Unlike other planning solutions, the implementation of Akili’s solution is not the end of your planning journey. Users can easily add custom dashboards to the solution’s capability. The flexibility of the Anaplan platform allows extending asset planning data into a full financial plan, incorporating other operating expenses and workforce planning to build a complete financial view of your organization.

Solution features

The Akili solution provides well-level planning capability in the following areas:

- Volume planning with multiple streams and gross/net.

- Price decks with commodity pricing and differentials.

- Revenue forecasts based on price and volume forecasts with the ability to run pricing scenarios in real time.

- Complex scenario analysis that allows variations in drilling plan changes that impact volumes, revenue, and capital.

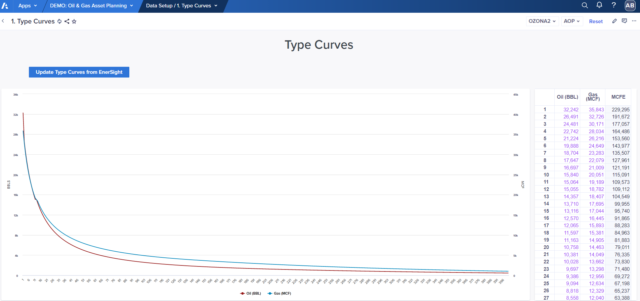

- Production decline curves allow modeling of well production using decline curve data or load from engineering data.

- Well capex models allow defining the models for well drilling, fracking, facilities, etc. for modeled well costs.

- Key dates such as SPUD date, rig release, fracking begin/end, and prod start, drive the timing of well costs and production.

- Operational modeling impacts are fully integrated into income statement, balance sheet, and cash flow in real time.