Partner badge

Solution Advisory & Delivery

Function

Finance

Industry

Banking & Capital Markets, Business Services, Real Estate & Construction, Technology & Software, Telecom, Travel & Entertainment

Region

Global

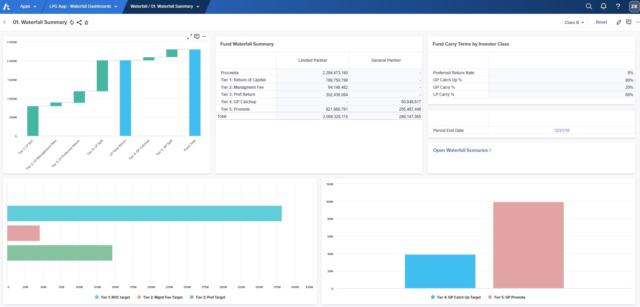

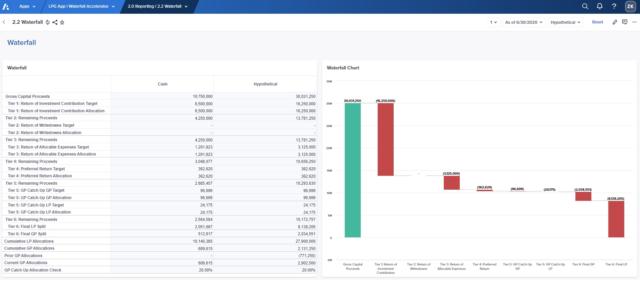

This Waterfall Automation solution for private equity funds takes a feed of investor capital (from source systems Investran, eFront, AltaReturn or other) and calculates a distribution waterfall at the lowest level of detail required. The waterfall is made up of return of capital, preferred return, GP/LP catch-up and carried interest. Scenario modeling includes flexes on preferred return rate, catch-up and carry splits, future cash flows and exit dates, as well as a holdback provision on investor distributions, in cash or percentage terms.

Request a demoModel complexity with accuracy, transparency, and flexibility

LPA’s can be complex, particularly for your largest and most important investors. Give your fund managers an edge, speed up your ability to report to IR and LP’s, and enable a scalable platform that allows you to accurately and securely disseminate waterfall activity to the appropriate parties. Anaplan can extend beyond the waterfall to Carry allocations to GP members, Tax, and performance reporting.

Solution features

- Model hypothetical and realized waterfall distributions accurately

- American / European / Hybrid style, by fund, LP and Investment

- Ability to model Co-Invests, differing LPA terms, SMAs with ease

- Model at the investor and/or investment level by fund

- View waterfall charts itemizing ROC, Pref, Catch-up, and Carry

- Real-time waterfall recalculation as model assumptions change

- Integration with Investran, FrontInvest, Vitech, AltaReturn and other cashflow ledgers

- Ability to model by vehicle, easing tax reporting and Carry allocations to GP members

- Ability to grant secure, auditable access to fund administrators and LP finance teams as needed

- Easily export any data grid to Microsoft Excel

Supporting links and docs

- Download the Guide: How Private Equity Firms can Evolve in a Data Driven World

- Private Markets Educational Series: Lionpoint Group Interview - Data transparency