Partner badge

Solution Advisory & Delivery

Function

Finance

Industry

Banking & Capital Markets, Real Estate & Construction

Region

America, Asia Pacific, Europe, Global, Middle East

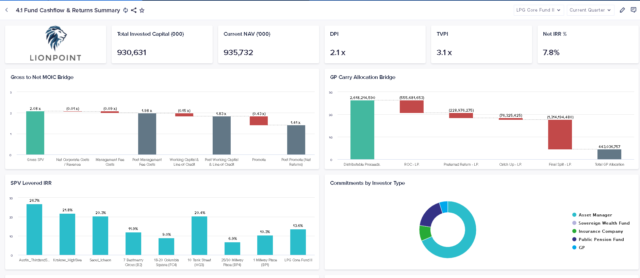

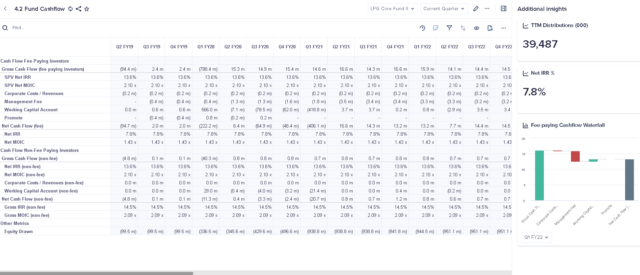

In a sector faced with increased market uncertainty, rapidly growing AUM, and additional investor and regulatory requirements, technology must play a key role in enabling asset managers to scale and adopt effective investment strategies. A heavy use of Excel, has also led to siloed data and manual processes that make it challenging to offer quick insights and auditability.

The Fund Budgeting & Forecasting solution solves these challenges by enabling collaboration and greater insight across fund managers, associates, and administrators. Adapt to a rapidly changing market through quick scenario modelling and automated client reporting.

Request a demoSolution features

- Apply greater control and process efficiency to the client reporting process.

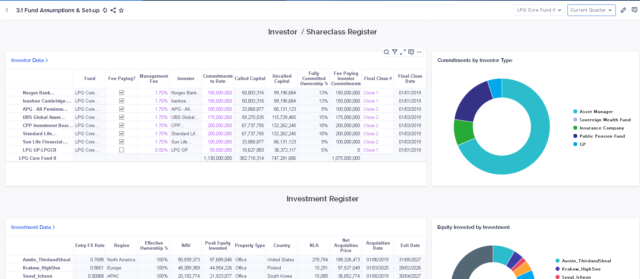

- Manage multiple holdings of a single asset across funds.

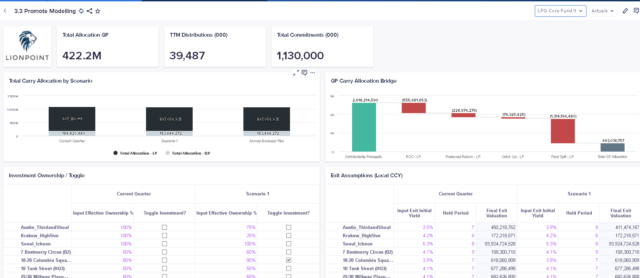

- Create new fund models or scenarios quickly.

- Run hold/sell scenarios in seconds and review impacts on fund performance and carry.

- Streamline quarterly client fund reporting processes.

- Automate management fee & promote forecast calculations.

- Import asset cashflows and supporting data from Anaplan models or other sources.

- Produce forecast LP performance reporting.

Supporting links and docs

- Leveraging Anaplan for essential real estate asset modeling in a rapidly changing environment

- Connected Planning and its impact on commercial real estate