Partner badge

Solution Advisory & Delivery

Function

Finance

Industry

Banking & Capital Markets, Business Services, Consumer Products, Energy & Resources, Government & Education, Hospitality, Insurance, Life Sciences & Healthcare, Manufacturing, Media & Communications, Other, Retail, Technology & Software, Telecom, Travel & Entertainment

Region

Europe, Middle East

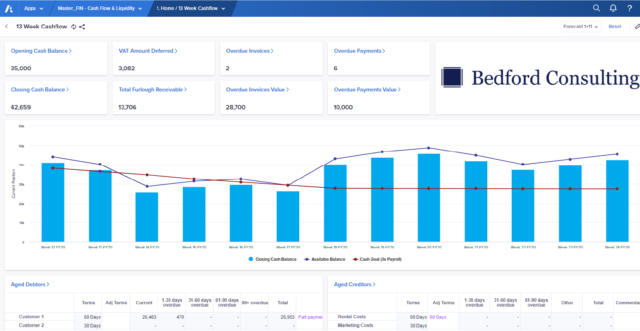

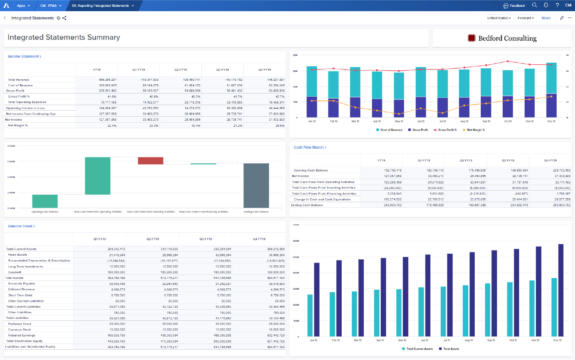

Using Anaplan for Cash Flow Forecasting provides a fully integrated approach to forecasting accounts receivable and accounts payable balances.

Highly customisable based on your business needs and quick to deploy, Anaplan enables you to unwind your accounts receivable and accounts payable balances, manage your workflow, and understand how specific actions improve your working capital and impact your cash flow. With robust calculation capabilities and in-memory power, you can swiftly import and analyse the entire ledger, allowing you to work at a finer level of granularity, such as by business unit, customer type, or payment method.

Request a demoUsing Anaplan for Cash Flow and Liquidity Planning in volatile conditions

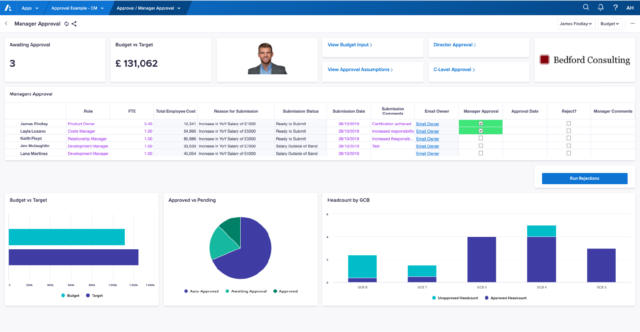

Keeping tight controls over cash flow is one of the core pillars of business liquidity. The Bedford model allows users clear visibility over how their ledgers should transition to cash as well as allowing them to forecast ahead for both sales and costs cash impacts. Scenario modelling is a key aspect of cash planning, Anaplan is the ideal platform to enable this in a quick and easy way, allowing business users to compare and contrast various “what if” scenarios to seek out the best solution for the organisation.

Solution features

Key benefits:

- Quickly update sales and purchase ledgers into your short-term cash flow.

- Overlay payment terms to progress or delay invoice payment.

- Review aged creditors/debtors across multiple versions.

- Forecast sales and purchases by customer and supplier.

- Model various payment terms to see the impact on cash.

- Forecast employee costs and utilises furlough schemes where required.

- Review cash flow by currency to identify currency-specific weakness.

- Quickly roll forward to a new 13 week timescale or create multiple like-for-like scenarios.

- Quickly model forecast scenarios.